Capital expenditures

| Capital expenditures / € million | 2024 | 2023 | Change | |

|---|---|---|---|---|

| absolute | % | |||

| Gross capital expenditures 1) | 18,247 | 15,917 | +2,330 | +14.6 |

| Investment grants 1) | 9,218 | 9,286 | –68 | –0.7 |

| Net capital expenditures | 9,029 | 6,631 | +2,398 | +36.2 |

| Equity increases by the Federal Government to finance infrastructurecapital expenditures 2), 3) | 3,085 | 1,290 | +1,795 | +139 |

| DB-financed net capital expenditures | 5,944 | 5,341 | +603 | +11.3 |

1) Figure for 2023 adjusted due to the reclassification of DB Schenker.

2) Excluding equity injections in conjunction with the Climate Action Program.

3) Cash inflow in 2024 also retroactively for 2023.

- The development of gross capital expenditures was largely driven by higher capital expenditures to improve the quality and availability of the rail infrastructure. In rail freight transport, capital expenditures in the vehicle fleet increased. In passenger transport, capital expenditures decreased significantly overall, partly due to the finalization of vehicle projects.

- The reported net capital expenditures have also increased significantly. As a result of the Federal Government’s decision to provide funds for capital expenditures in the rail network from 2024 also in the form of equity increases, these must also be taken into account on a comparable basis when considering the net capital expenditures. The corresponding Government funds were therefore deducted from the gross capital expenditures in the same way as the investment grants to determine the DB-financed net capital expenditures.

- Investment grants and equity increases as part of infrastructure financing increased significantly overall. In total, they accounted for about 67% (previous year: about 66%) of gross capital expenditures.

- Investment grants, which are also largely attributable to infrastructure in 2024, were roughly on a par with the previous year.

- Capital expenditures financed by means of equity increases rose significantly. These were exclusively infrastructure capital expenditures. In the previous year, these were initially financed as pre-financings from DB funds and then replaced in 2024 by funds from the Federal Government’s equity increases.

The focus of our capital expenditure activities remains on improving the performance capability, efficiency and quality of our rail infrastructure and expanding our vehicle fleet.

| Gross capital expenditures by regions / € million | 2024 | 2023 | Change | |

|---|---|---|---|---|

| absolute | % | |||

| Germany 1) | 18,221 | 15,890 | +2,331 | +14.7 |

| Europe (excluding Germany) 1) | 150 | 139 | +11 | +7.9 |

| Rest of world 1) | 12 | 7 | +5 | +71.4 |

| Consolidation | –136 | –119 | –17 | +14.3 |

| DB Group 1) | 18,247 | 15,917 | +2,330 | +14.6 |

1) Figure for 2023 adjusted due to the reclassification of DB Schenker.

| DB-Financed net capital expenditures (after equity financing of the FederalGovernment) by regions / € million | 2024 | 2023 | Change | |

|---|---|---|---|---|

| absolute | % | |||

| Germany 1) | 5,918 | 5,320 | +598 | +11.2 |

| Europe (excluding Germany) 1) | 150 | 133 | +17 | +12.8 |

| Rest of world 1) | 12 | 7 | +5 | +71.4 |

| Consolidation | –136 | –119 | –17 | +14.3 |

| DB Group 1) | 5,944 | 5,341 | +603 | +11.3 |

1) Figure for 2023 adjusted due to the reclassification of DB Schenker.

In terms of the regional distribution of gross and DB-financed net capital expenditures, the focus remained almost entirely in Germany. Development of capital expenditures in the regions Europe (excluding Germany) and rest of world was influenced by regional developments at DB Cargo and the activities of DB E.C.O. Group.

Figures for 2023 adjusted due to the reclassification of DB Schenker.

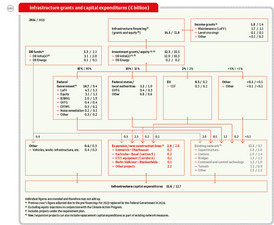

In addition to the Federal Government’s equity measures to finance infrastructure capital expenditures, the main sources of funding for infrastructure capital expenditures are grants mainly from the Federal Government, the Federal states and local authorities. The investment grants received by DB Group in 2024 also largely went to infrastructure.

- The main basis for this are the LuFV and the Federal Rail Infrastructure Extension Act (Bundesschienenwegeausbaugesetz; BSWAG).

- Additional investment grants are received in accordance with the Municipal Transport Financing Act (Gemeindeverkehrsfinanzierungsgesetz; GVFG),

- the Federal Government’s noise remediation program, and

- to equip the infrastructure with the European Rail Traffic Management System (ERTMS).

- Funds are also available from the 2021 Reconstruction Fund to remedy flood-related infrastructure damage.

- The European Union allocates grants (Connecting Europe Facility; CEF) for infrastructure capital expenditures on Trans-European Networks (TEN).

In addition to investment grants, DB Group also receives grants recognized as income, which are also largely attributable to infrastructure. Since 2024, as a result of amendments to the BSWAG and the LuFV, expenses for the maintenance of rail infrastructure can also be subsidized by the Federal Government. The grants recognized in income, therefore, increased significantly in 2024. In addition, the cash inflows in 2024 included the repayment of measures pre-financed by DB Group in 2023.

On the balance sheet, investment grants are directly deducted from acquisition cost and cost of production of the assets to which they relate. All grants and equity measures are recorded in such a way that the competent Federal agencies can conduct comprehensive checks to ensure that they are spent in accordance with their purpose and the law. Grants received in the form of equity are financings of subsidized assets that do not change the acquisition and production costs.