Our mid- and long-term targets

Mid-term restructuring targets

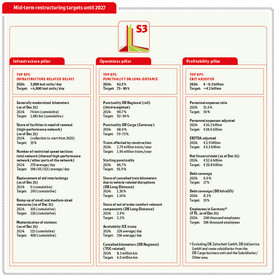

By way of the measures set out in the S3 restructuring program, we want toregain our performance. We have defined a set of key figures for each pillar of the restructuring program, which we want to use to manage transparently and to make progress visible. In summary, there is at least one key performance indicator for each pillar that provides information about the success of the restructuring program.

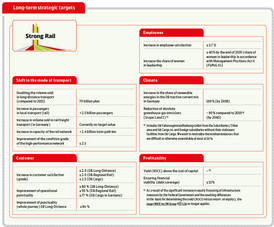

Long-term strategic targets

Our long-term strategic targets are based on key transport and climate policy framework conditions:

- doubling of volume sold in rail passenger transport, and

- increase rail’s market share in freight transport to 25%.

In addition, climate policy goals are supported by converting traction current to 100% renewable energies, the electrification of rail tracks and purchase of alternatively driven or hybrid-driven locomotives.

We use the relevant key performance indicators to pursue the achievement of our Strong Rail strategic targets. We refined these in 2023 and have since considered 14 DB-specific targets in the context of Strong Rail. In this way, we aim to better measure and steer the implementation status of Strong Rail even better.

Deviations from the forecast

| Outlook for the 2024 financial year | 2023 | 2024 (Mar 2024 forecast) | 2024 (Jul 2024 forecast) | 2024 |

|---|---|---|---|---|

| Volume sold in long-distance transport (billion pkm) | 45.5 | ~ 47 | ~ 45 | 44.1 |

| Passengers regional transport (rail) (billion) | 1.7 | ~ 1.9 | ~ 1.8 | 1.7 |

| Volume sold in freight transport (Germany) (billion tkm) | 51.9 | – | ~ 49 | 46.4 |

| Train kilometers on track infrastructure (Germany) (billion train-path km) | 1.12 | ~ 1.15 | ~ 1.12 | 1.10 |

| Condition grade of high-performance network (grade) | 3.1 | 2.8 | - | 3.0 |

| Customer satisfaction DB Long-Distance (grade) | 2.7 | 2.6 | 2.7 | 2.7 |

| Customer satisfaction DB Regional (rail) (grade) | 2.2 | 2.2 | 2.2 | 2.2 |

| Customer satisfaction DB Cargo (grade) | 2.8 | 3.0 | 2.9 | 2.9 |

| Punctuality (operational) DB Long-Distance (%) | 64.0 | ~ 70 | 63–67 | 62.5 |

| Punctuality (whole journey) DB Long-Distance (%) | 68.9 | ~ 74 | 68–72 | 67.4 |

| Punctuality DB Regional (rail) (%) | 91.0 | ~ 93 | 90–92 | 90.3 |

| Punctuality DB Cargo (Germany) (%) | 70.5 | ~ 69 | 67–70 | 68.0 |

| Absolute greenhouse gas emissions Scope 1 and 2 1) (million t) | 3.3 | ~ 3.2 | ~ 3.2 | 3.0 |

| Share of renewable energies in the DB traction current mix (Germany) 2) (%) | 68.0 | ~ 69 | ~ 69 | 69.8 |

| Employee satisfaction 3) (SI) | – | 3.7 | 3.7 | 3.8 |

| Women in leadership 3) (%) | 29.4 | ~ 30 | >30 | 31.5 |

1) Includes only DB Fahrzeuginstandhaltung GmbH from the Subsidiaries/Other area and only DB Cargo AG and foreign subsidiaries without their stationary facilities from DB Cargo.

2) The data for 2024 constitute a forecast as of February 2025. Since 2023, the proportion of renewable energies has been presented separately without Renewable Energy Sources Act (EEG) funding.

3) DB Group, including the discontinued operation DB Schenker.

The development of DBGroup has deviated in the following areas from our forecast for the 2024 financial year as published in the Integrated Interim Report 2024:

- Performance development: Overall below our expectations from July 2024:

- The volume sold in long-distance transport and the number of passengers in local rail transport were slightly below our forecast due to the weak operational quality and as a result of one-off events (e.g. GDL strikes).

- The volume sold of our German rail freight transport fell well short of the forecast. Additional burdens resulted primarily from the fact that economic impulses were weaker than expected.

- The train kilometers on track infrastructure in Germany was slightly below our forecast, as demand, particularly from intra-Group customers, was weaker than expected, especially in local passenger and rail freight transport.

- Condition grade high-performance network: The forecast for the development of the condition grade of the high-performance network could not be achieved due to a negative base effect. Taking into account the base effect, the development was in line with our expectations.

- Punctuality: The forecasts for operational punctuality and punctuality (whole journey) for DB Long-Distance were missed because the effects of improvement measures were overcompensated by counteracting structural effects and individual events with an impact on punctuality that were not included in the forecast to this extent.

- Profitability: For further information, see deviations from the forecast (profit development).

- Climate protection:

- The absolute greenhouse gas emissions in Scope 1 and 2 have fallen more sharply than expected, which is mainly due to consistently lower heat consumption (natural gas, district heating, heating oil) as a result of the mild weather in 2024, the decline in volume produced in rail freight transport and the increased use of HVO No. 164 as a substitute for conventional diesel fuel.

- The increase in the share of renewable energies compared to the forecast was due to the current market situation, which had a positive impact on power plant deployment planning.

- Social:

- The decline in employee satisfaction was lower than predicted. The main reason for this was the mutually perceived commitment of the employees on-site.