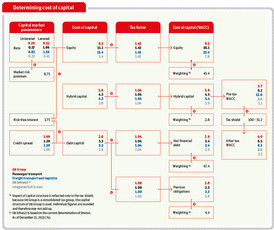

Cost of capital

The cost of capital is updated annually to take account of changes in market parameters. We take the long-term focus of the controlling concept into consideration and balance out short-term fluctuations. The decline in the cost of capital before and after taxes for DB Group and the Integrated Rail System in 2023 resulted from the stronger weighting of the infrastructure business units as a result of additional capital expenditures on infrastructure.

We calculate DB Group’s cost of capital as a weighted average interest rate of equity, hybrid capital, net financial debt and pension obligations. Determined annually, this reflects current capital market parameters, the prevailing tax framework and the value share of methods used to finance capital employed.

When determining the company-independent capital market parameters, market risk premium and risk-free interest rate, short-term fluctuations in debt and equity market yields are smoothed out in line with the long-term focus of our value management concept. The parameters are determined on the basis of the yields on long-term German Federal bonds as well as the long-term average returns of the German DAX equity index. As the period of low interest rates ended, we have put more emphasis on the recent past more strongly since the previous year. The parameters used are also validated on the basis of up-to-date recommendations of recognized valuation experts. The company-dependent capital market parameters, beta and credit spread, measure the risk of our debt and equity financing in comparison with alternative forms of investment. Beta reflects the risk of equity capital relative to the risks of the equity markets. The determination is based on international peer companies at business unit level. The credit spread corresponds to DB Groupʼs current issue costs relative to German Federal bonds (term of about 12 years). The credit spread for the transport and logistics area is determined in line with market conditions, using the current capital market data of companies with comparable creditworthiness.

Tax factors are calculated using a taxation rate of 31.2% (previous year: 30.5%). The tax factor for net financial debt reflects the trade tax applied to fixed debt interest to be credited. The taxes remaining after this are fully allocated to cost of equity. The weighting of forms of financing is based on market values. Net financial debt and pension obligations are valued at their carrying amounts. Equity weighting is based on recognized business valuation methods.

The weighting of forms of financing is standardized, as the tax shield resulting from the tax-deductible status of debt interest arises, as a rule, from the fact that DB Group is a consolidated tax group.