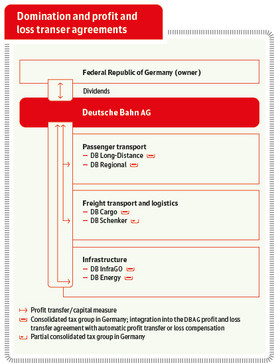

Domination and profit and loss transfer agreements

Profit transfer and loss compensation between companies in Germany do not constitute service relationships. On the contrary, the profit and loss transfer agreement stipulates that the amount of profit distributed or the sum required to offset losses is not reset every year but is calculated automatically. The cash flow is based on the shareholder’s right to profits or obligation to compensate any losses. Notwithstanding this, DB Group ensures that Group companies have a sufficient equity base despite the commitment to offset potential losses generated by individual companies within DB Group.

Investors are only willing to provide capital if amortization and interest yields are ensured. A purely debt-based financing model is not commercially viable, as it is associated with too high risks. Profits are essential for maintaining DB Group’s capital expenditure capacity. Profits generated are either retained or distributed to the Federal Government as the sole shareholder. The share of profit retained (accumulated) in DB Group increases the capital expenditure and borrowing capacity.

Annual profit transfers and loss compensation within DB Group are reflected in the net investment income of DB AG.

Within the framework of LuFV, the Federal Government and DB Group have contractually agreed that in the event of a dividend payment by DB AG to the Federal Government, the dividend will be used by the Federal Government to carry out replacement capital expenditures in the rail infrastructure. As a result, the after-tax profits of the rail infrastructure companies (RICs) are distributed in full to the Federal Government and also fully reinvested in the infrastructure. This mechanism ensures that profits from infrastructure are channeled entirely into the infrastructure as investment grants and remain there. In contrast to alternative profit retention, there is no increase in the capital employed. In LuFV III, assumptions were made regarding the level of the annual dividend, which were incorporated into the total amount of LuFV funds. In line with the LuFV assumptions, a dividend payment of € 650 million was made by DB AG for the 2022 financial year in 2023, which was reinvested in full as investment grants for rail infrastructure. The dividend paid in 2023 therefore exceeded the RICs’ profits of € 541 million in the 2022 financial year.

Cash flows DB AG and DB infrastructurecompanies / € million | 2000 to 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

From capital increases by DB AG | |||||||||||||||

DB InfraGO AG (formerly DB Netz AG) | +1,220 | – | – | +5 | – | – | – | +1,000 | – | – | – | +1,125 | +1,300 | +1,125 | +5,775 |

DB Station&Service AG 1) | +425 | +14 | – | – | – | – | – | – | – | – | – | +1,000 | +49 | +2 | +1,490 |

Total | +1,645 | +14 | – | +5 | – | – | – | +1,000 | – | – | – | +2,125 | +1,349 | +1,127 | +7,265 |

From profit and loss transfer agreementsto (–)/from (+) DB AG | |||||||||||||||

DB InfraGO AG (formerly DB Netz AG) | +1,290 | –307 | –197 | –66 | –217 | –81 | –280 | –390 | –509 | –402 | +23 | +139 | –403 | +1,634 | +234 |

DB Station&Service AG 1) (until April 30, 2023) | –463 | –155 | –160 | –169 | –188 | –203 | –176 | –186 | –190 | –146 | +32 | +61 | +2 | –7 | –1,948 |

DB Energie GmbH | –563 | +38 | –62 | +37 | –39 | –51 | –35 | –59 | –12 | +3 | +66 | –126 | –140 | –166 | –1,109 |

Total | +264 | –424 | –419 | –198 | –444 | –335 | –491 | –635 | –711 | –545 | +121 | +74 | –541 | +1,461 | –2,823 |

Dividend payment to the Federal Government (for previous year) | |||||||||||||||

DB AG | – | –500 | –525 | –525 | –200 | –700 | –850 | –600 | –450 | –650 | –650 | – | – | –650 | –6,300 |

(+) Cash inflow

(–) Cash outflow

1) DB Station&Service AG was merged with DB InfraGO AG with effect from May 1, 2023.