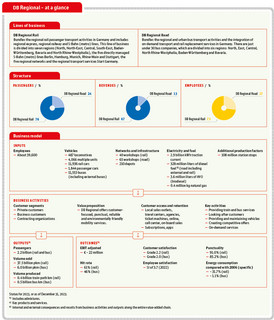

Business model

The core service of DB Regional is to bring millions of passengers in regional transport to their destination every day on time and in a safe, punctual, comfortable and environmentally friendly manner, and in doing so, to meet the requirements of the respective transport contracts.

Our offerings cover regional rail passenger transport with regional express, regional railway and S-Bahn (metro) lines as well as regional and urban bus transport services.

These core products are supplemented with concepts for new forms of mobility. Examples of such forms of mobility are, in particular, on-demand transport services and mobility hubs. A high level of customer acceptance of such offers requires progressive integration on three levels: physical, digital and regarding tariffs.

The focus of DB Regional’s vision of sustainable everyday mobility is an intelligent linking of the entire mobility portfolio towards fully integrated mobility solutions in large-scale transport areas. Together with our public transport services and contracting organizations, we are pursuing the progressive, long-term expansion of integrated transport concepts: seamless door-to-door offers for our passengers, which will be facilitated by the intelligent combination of scheduled rail and road transport services with sharing and on-demand services. With this holistic approach, we offer our passengers comprehensive mobility services, not only in metropolitan regions and conurbations but also in rural areas with public mobility. Our regional structure ensures a modern local transport service that is oriented equally towards local customer needs as well as ordering requirements.

As a rule, DB Regional provides its regional rail passenger transport services within the framework of the Regionalization Act as a public service and on behalf of the competent contracting organizations. The contracting organizations are either the Federal states or state-owned companies, or municipal special-purpose associations. The contracting organizations conclude long-term transport contracts in the framework of mostly competitively awarded tenders or grant corresponding route concessions to transport companies. These contracts determine the volume produced and contain detailed specifications on quality and fare pricing. With integrated transport concepts, high-quality mobility services and targeted investments in our fleet as well as product development and digitalization, DB Regional intends to safeguard its leading market position and further strengthen its role as a quality and innovation leader in regional rail passenger transport.

Important performance figures are volume sold and volume produced, with transport contracts usually relating to volume produced. In addition to concession fees, revenues from ticket sales are traditionally the most important source of income. Contracts where fare proceeds remain directly with the contracting organization, while the transport company is fully compensated by the contracting organization for the entire range of services (gross contracts), are of increasing importance.

Predefined periods in transport contracts and route concessions, combined with the necessity of an extensive production system, result in a cost structure characterized by fixed costs. The key drivers are personnel, maintenance, energy and infrastructure expenses. Only a small portion of expenses varies with the load factor.

In the rail sector, integrated offerings covering vehicle procurement, financing, fleet management, operation and maintenance were generally required by the contracting organizations in the past. There are now also fragmented tender models. In such models, modular partial services or even just solely the operation are put out to tender. In these models, other partial services remain the responsibility of the contracting organizations (financing, for example) or the responsibility of the vehicle suppliers (maintenance, for example). Based on the performance capability of DB Regional in all value-added levels, partial services can also be assembled as required so that DB Regional also successfully holds its ground on the market as a provider of partial services and/or subcontractor of competitors.

Competition in the regional bus segment remains strong in the national bus market. The intensity of competition in this small-scale and regional market (approximately 400 contracting organizations in Germany) results both from Europe-wide tenders and from licensing competition. In the area of tenders, volume sold is predominantly represented in gross contracts (compensation by concession fees) with a period of eight to ten years. In urban transport, bus services are often awarded to local municipal companies through in-house tenders, and are (in part) provided as subcontractor services by regional transport companies. The biggest challenges facing the bus business are the need for personnel/a shortage of skilled labor, especially for passenger transport staff, as well as the price trend with the most important factor costs, fuel (diesel/energy).

At the same time, the integration of scheduled and on-demand transport provides the opportunity to make local transport on the road more efficient. In the future, this will require functional tenders that make it possible to design transport services from the customer’s point of view: smaller, often electric vehicles, especially on less busy lines and at daytime off-peak times, run as required and operate a strong line network on road and rail in a feeder system, facilitating public door-to-door travel chains.

DB Regional recognized this development at an early stage and, in collaboration with internal and external partners, it offers holistic solutions from the first to the last mile under the umbrella of DB Regional Road.