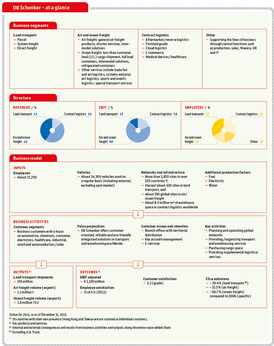

Business model

DB Schenker is one of the top four global logistics companies in the market and serves established markets and emerging economies with a global network:

- Land transport: DB Schenker’s network connects the most important economic regions in Europe. Services include time- and cost-optimized services for groupage, partial and full load transport along with door-to-door solutions across Europe. Land transport in America is becoming an increasingly important area of activity. In addition to serving the North American markets, activities in South America are being expanded. DB Schenker is also expanding its land transport business in the growth market of Asia.

- Air and ocean freight: As one of the world’s leading providers, DB Schenker offers the full range of services in this segment, including climate-friendly services.

- Contract logistics: The services offered cover all stages of the value-added chain from suppliers to producers/trade, end customers and spare parts services. The core area of expertise is the planning and handling of global supply chains, including sustainable logistics concepts.

With about 72,700 employees at more than 1,850 locations in more than 130 countries, DB Schenker is one of the world’s leading logistics service providers. DB Schenker has a global customer base of about 400,000 customers in a wide range of industries and with a focus on industrial customers. The vertical market approach is aimed at developing industry-specific solutions. Important major customers are supported with tailor-made solutions.

In air and ocean freight, DB Schenker operates exclusively as a freight forwarder without its own aircraft and vessels, but in air freight with a time-diversified charter strategy on the main trade lanes. In contrast, in some segments of land transport, own vehicles and containers are used. Transshipment terminals and warehouses are mostly the property of DB Schenker or are leased over the longer term. In addition to airlines and shipping companies in air and ocean freight, our major partners include land transport subcontractors for the supply of transport services.

The volume-based key figures depend on the line of business:

- in land transport it is the number of shipments,

- in air freight it is the tons billed, and

- in ocean freight it is the freight volume measured in TEU.

There is no comparable volume-based KPI in the contract logistics segment. In this case, market comparisons are usually made on the basis of revenues.

DB Schenker has a relatively low capital intensity and depth of added value. About 70% of revenues in the transport lines of business come from procured intermediate input services. Therefore, optimizing these purchase relationships and balancing various influential success factors, such as transport relations, volume, weight and mode of transport, represents an important factor for success and a value driver. The same applies to managing fluctuations in freight rates and the specific surcharges to these freight rates. One of the essential factors besides gross profit is the effective and efficient use of personnel. This is of particular importance in contract logistics. Here, know-how and experience relevant to the industry are essential success factors in the optimal design of intra-company logistics processes. Effective IT support is also especially important.

The most important sources of income are transport and logistics services, including services with added value concentrating on the strategic areas of aftermarket, cloud, finished goods fulfillment, omnichannel and medical devices, with a focus on supporting the electronics, healthcare, industrial and e-mobility sectors.