Overview of key figures

Revenues significantly above pre-Covid-19 level, operating profit significantly positive again.

Read more

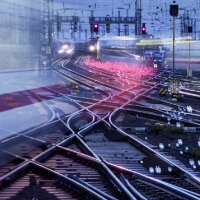

In Germany, punctuality in rail transport decreased significantly.

Read more

As part of our DB Group climate protection target, in 2022, we were able to further reduce specific greenhouse gas emissions.

Read more

In 2022, we also increased the share of renewable energies in the DB rail traction current mix in Germany.

Read more

External new hires in Germany (excluding young professionals) in NP.

Read more

Employee satisfaction

Employee satisfaction is determined every two years as part of the employee survey ... read more

New hires

In 2022, about 26,700 new employees in Germany completed their first working day at DB Group ... read more

Work of the future

In order to strengthen our ability to innovate and prepare ourselves for the future, we intend to actively shape the work of the future in DB Group ... read more

Diversity

DB Group’s commitment to the diversity of its employees is anchored in the Strong Rail strategy ... read more

Employment conditions

We are continuing to improve employment conditions, based on current and future social developments, as well as employees’ and applicants’ expectations of ... read more

Employer attractiveness

In 2022, we continued our employment campaign despite a tense labor market ... read more