Cost of capital

The cost of capital is updated annually to take account of changes in market parameters. We take the long-term focus of the controlling concept into consideration and balance out short-term fluctuations.

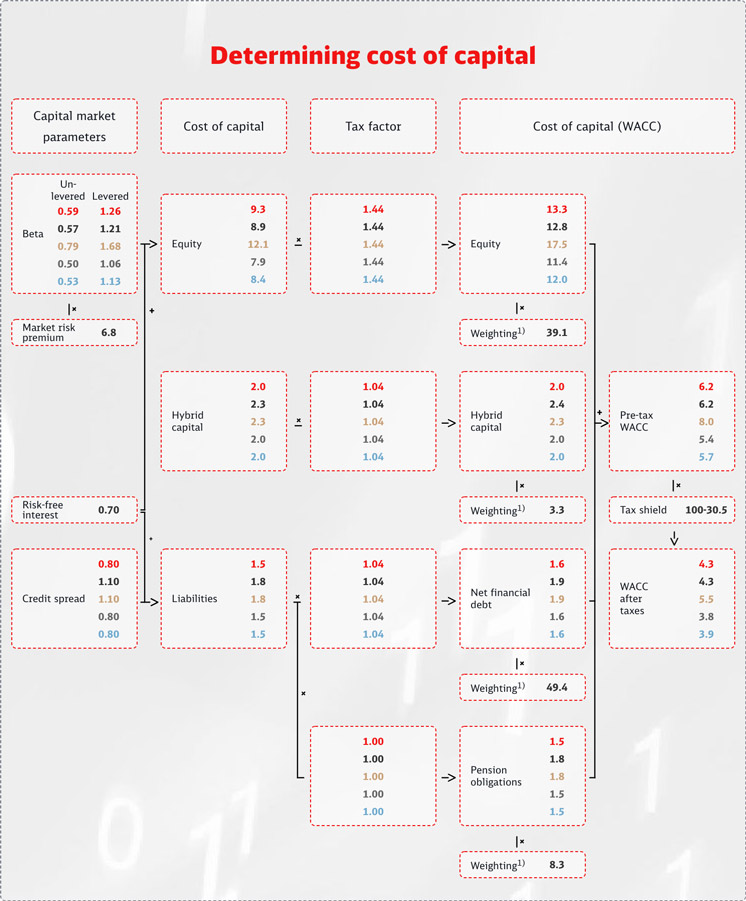

In 2021, the pre-tax cost of capital for DB Group remained the same. After taxes, the cost of capital remained at 4.3%.

We calculate DB Group’s cost of capital as a weighted average interest rate of equity, hybrid capital, net financial debt and pension obligations. Determined annually, this reflects current capital market parameters, the prevailing tax framework and the value share of methods used to finance capital employed.

When determining the company-independent capital market parameters, market risk premium and risk-free interest rate, short-term fluctuations in debt and equity market returns are smoothed out in line with the long-term focus of our value management concept. The parameters are determined on the basis of the yields on long-term German Federal bonds as well as the long-term average returns of the German DAX equity index. The parameters used are also validated on the basis of up-to-date recommendations of recognized valuation experts. The company-dependent capital market parameters, beta and credit spread, measure the risk of our debt and equity financing in comparison with alternative forms of investment. Beta reflects the risk of equity capital relative to the risks of the equity markets. The determination is based on comparable international companies at business unit level. The credit spread corresponds to DB Groupʼs current issue costs relative to Federal Government bonds with an imputed term of 12 years. The credit spread for transport and logistics is determined in line with market conditions, using the current capital market data of companies with comparable creditworthiness.

Tax factors are calculated using a taxation rate of 30.5%. The tax factor for net financial debt reflects the trade tax applied to fixed debt interest to be credited. The taxes remaining after this are fully allocated to cost of equity. The weighting of forms of financing is based on market values. Net financial debt and pension obligations are valued at their carrying amounts. Equity weighting is based on recognized business valuation methods.

The weighting of forms of financing for passenger transport, rail freight transport, logistics, infrastructure and the Integrated Rail System corresponds to that of DB Group, as the tax shield resulting from the tax-deductible status of debt interest arises, in general, from the fact that DB Group is a consolidated tax group.