Opportunity and risk management within DB Group

Opportunity and risk management within DB Group comprises the systematic identification, assessment and management of opportunities and risks. The primary objective of opportunity and risk management is to ensure the long-term future of DB Group.

The principles of opportunity and risk management are laid down by Group management and implemented on a Group-wide basis. Within the framework of our early-warning system, opportunity and risk reports are submitted to the Management Board and the Supervisory Board of DB AG three times a year. Risk reporting covers the medium-term period (five years). Major risks occurring outside of this reporting cycle must be reported immediately. Planned acquisitions are subject to additional specific monitoring.

Following the release of a new version of the IDWPS 340 audit standard (“Audit of the early risk detection system”), there are now additional requirements for DB Group’s risk management. Compared to the status quo, existential risks must now be evaluated on the basis of a defined risk-bearing capacity; the previous risk aggregation has also been adjusted. All other requirements of IDWPS 340 were already met by the existing risk management system.

Our risk management system (RMS) maps all of the opportunities and risks in an opportunity and risk portfolio and also individually in detail, factoring in materiality thresholds. A catalog of opportunity and risk categories serves to identify the relevant financial and sustainability-related opportunities and risks as fully as possible. This also includes risks that arise for companies in connection with the transition to a lower-carbon economy (transition risks), as well as physical risks as defined by the Task Force on Climate-related Financial Disclosures (TCFD). The opportunities and risks considered within the risk report are categorized and classified according to probability of occurrence. Together with possible consequences, the analysis also takes into account the starting position and the costs of countermeasures (gross and net result). Opportunities and risks are reported in the RMS depending on the probability of occurrence and the threshold value ( ≥ € 50 million). An exception only applies to regulatory information. The opportunities and risks are assessed against DB Group’s current medium-term planning, which covers a period of five years. Based on the opportunity and risk portfolio, an overall risk position is also determined by means of a stochastic simulation, which is used to assess developments that could jeopardize the company’s continued existence. In organizational terms, Group controlling is the central coordination point for our opportunity and risk management. Risks included in our medium-term planning are not included in the RMS. This relates to opportunities and risks with a probability of occurrence (PoO) > 70% (highly likely).

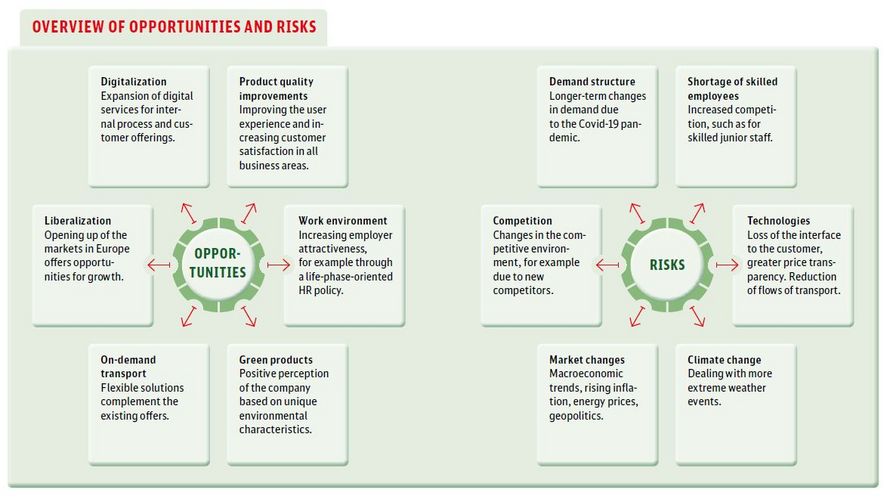

Our strategic opportunity and risk management efforts are mainly derived from the targets and strategies of our business units. Direct responsibility for early and regular identification, analysis and management of strategic opportunities and risks lies primarily with operational management personnel. These activities are an integral element of the Group-wide planning and controlling systems. We focus on detailed analyses of our markets and competitors, market scenarios, relevant cost drivers and critical factors for success, including those within our political and regulatory environment. Concrete opportunities are identified and analyzed from these activities.

DB Group’s business environment is in a state of constant change. We use DB.Trend.Radar to monitor the most important external developments for DB Group so that we can take advantage of opportunities and react to risks in good time. The focus is on the issue of how changes in society, politics, technology and the economy affect our markets. The individual topics are all highly interconnected and of great importance for the future of DB Group. DB.Trend.Radar helps DB Group to focus its business operations on the future and actively make use of opportunities.

In conjunction with Group financing, with its strict focus on the operating business, Group Treasury is responsible for limiting and monitoring the resulting credit, market price and liquidity risks. The centralized handling of relevant transactions (money market, securities, foreign exchange and derivative transactions) means that potential risks can be managed and limited centrally. Group Treasury is organized in line with the Minimum Requirements for Risk Management for Banks (Mindestanforderungen an das Risikomanagement; MaRisk), which means that it complies with the resulting criteria of the Act on Supervision and Transparency in the Corporate Sector (Gesetz zur Kontrolle und Transparenz im Unternehmensbereich; KonTraG).